Investor appetite surges as Uganda sells USh 2.96 trillion in bonds

The Bank of Uganda has successfully raised nearly USh 2.96 trillion through its October 1, 2025, Treasury bond auction, with strong investor demand across all three maturities on offer — 2-year, 5-year, and 15-year bonds.

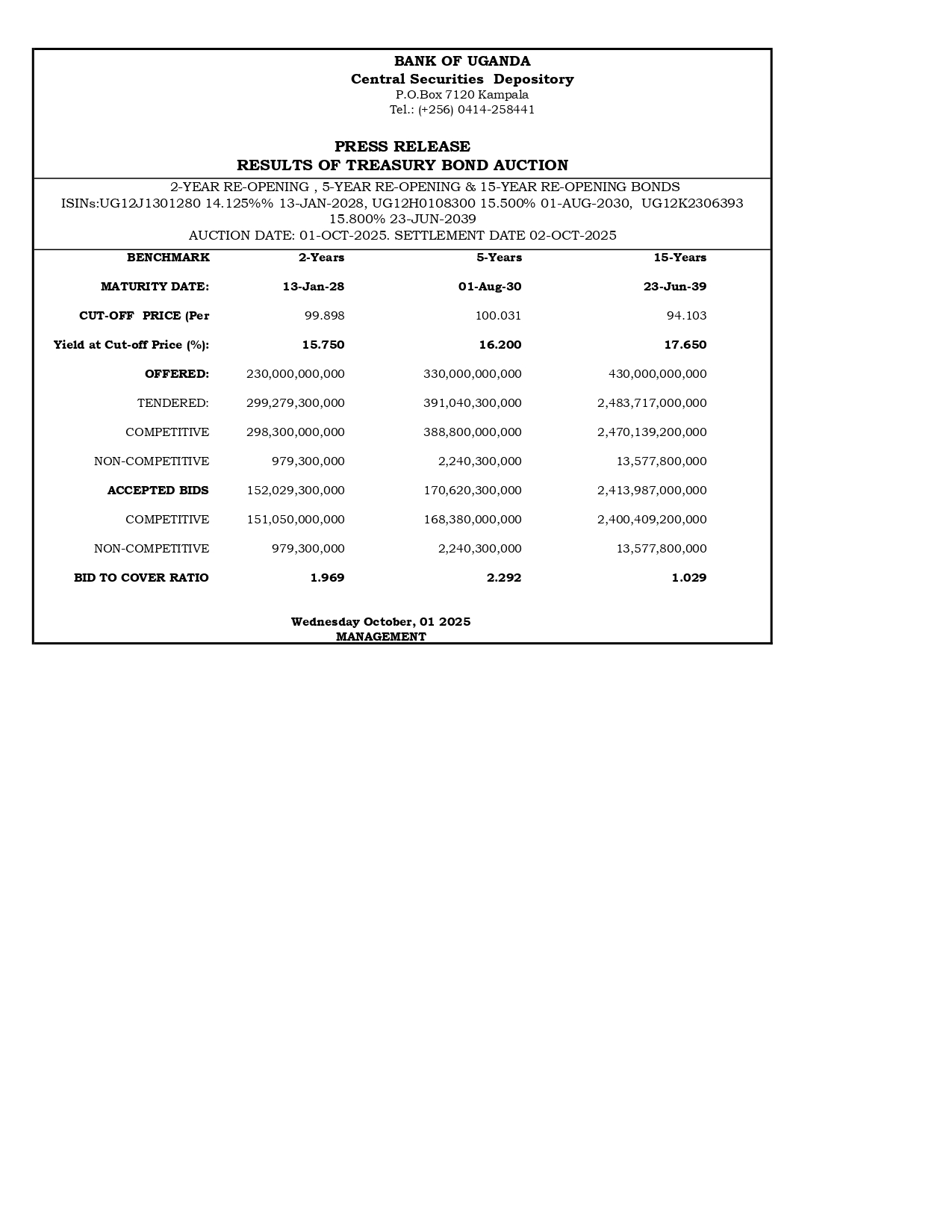

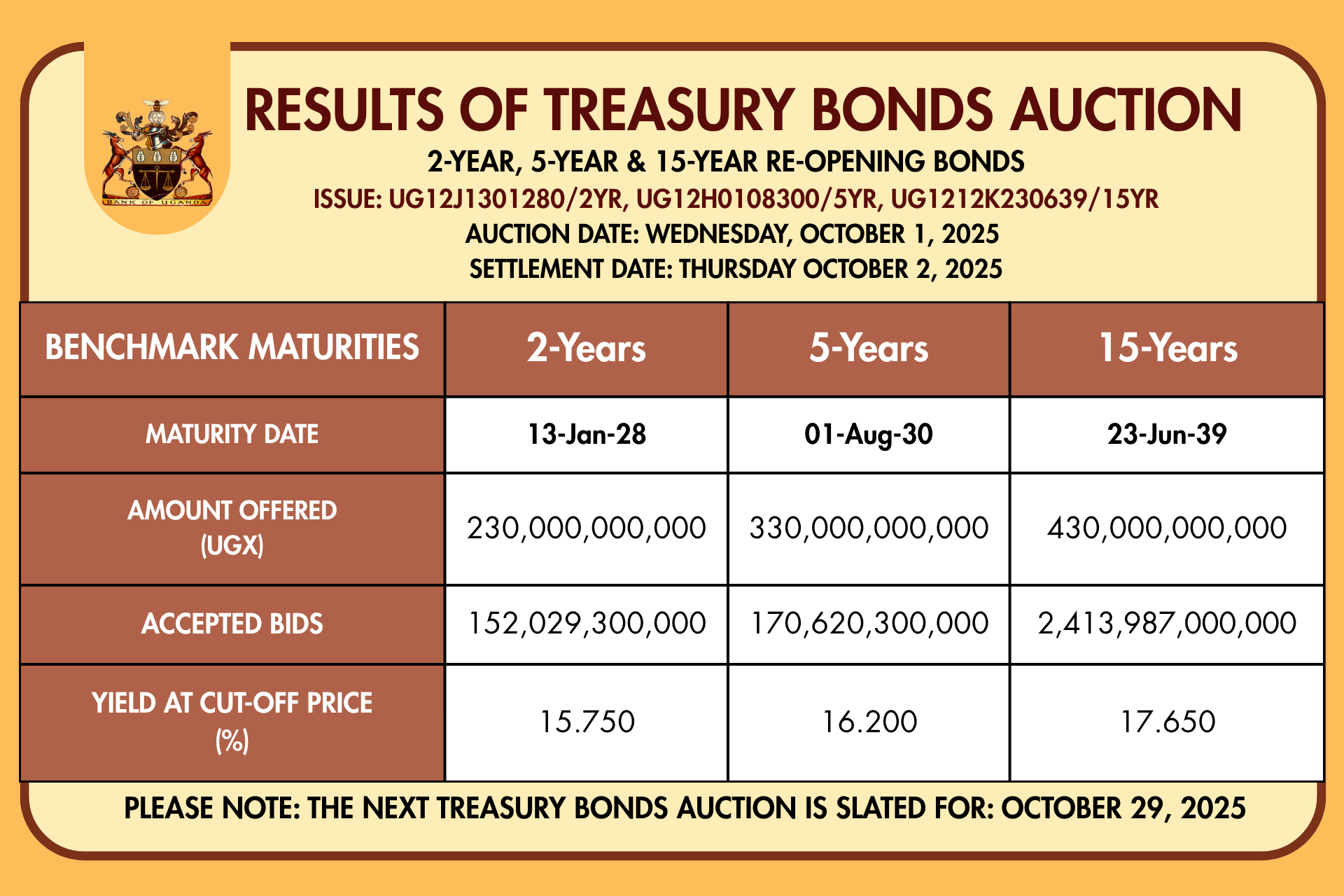

According to the central bank’s press release, the auction featured reopenings of existing bonds maturing on 13 January 2028 (2-year), 1 August 2030 (5-year), and 23 June 2039 (15-year).

Investor demand outstrips supply

The government had offered USh 230 billion (2-year), USh 330 billion (5-year), and USh 430 billion (15-year). However, total bids far exceeded the amounts on offer, with investors tendering:

USh 299.3 billion for the 2-year,

USh 391.0 billion for the 5-year, and

USh 2.48 trillion for the 15-year bond.

Of these, the accepted amounts were USh 298.3 billion (2-year), USh 388.8 billion (5-year), and USh 2.47 trillion (15-year), reflecting the strong appetite for longer-dated securities.

Yields and pricing

The cut-off yields stood at 15.75% for the 2-year bond, 16.20% for the 5-year bond, and 17.65% for the 15-year bond. Prices at cut-off were recorded at 99.898, 100.031, and 94.103 respectively.

The bid-to-cover ratios; a measure of demand — were 1.969 (2-year), 2.292 (5-year), and 1.029 (15-year), with particularly high investor interest in the shorter and medium-term maturities.

Market confidence

The results underscore continued investor confidence in government securities, especially the longer-term 15-year bond despite its higher risk profile. Analysts say the strong uptake reflects both the appetite for attractive yields and growing confidence in Uganda’s macroeconomic stability.