Airtel Money moves into global remittances with Juba Express partnership

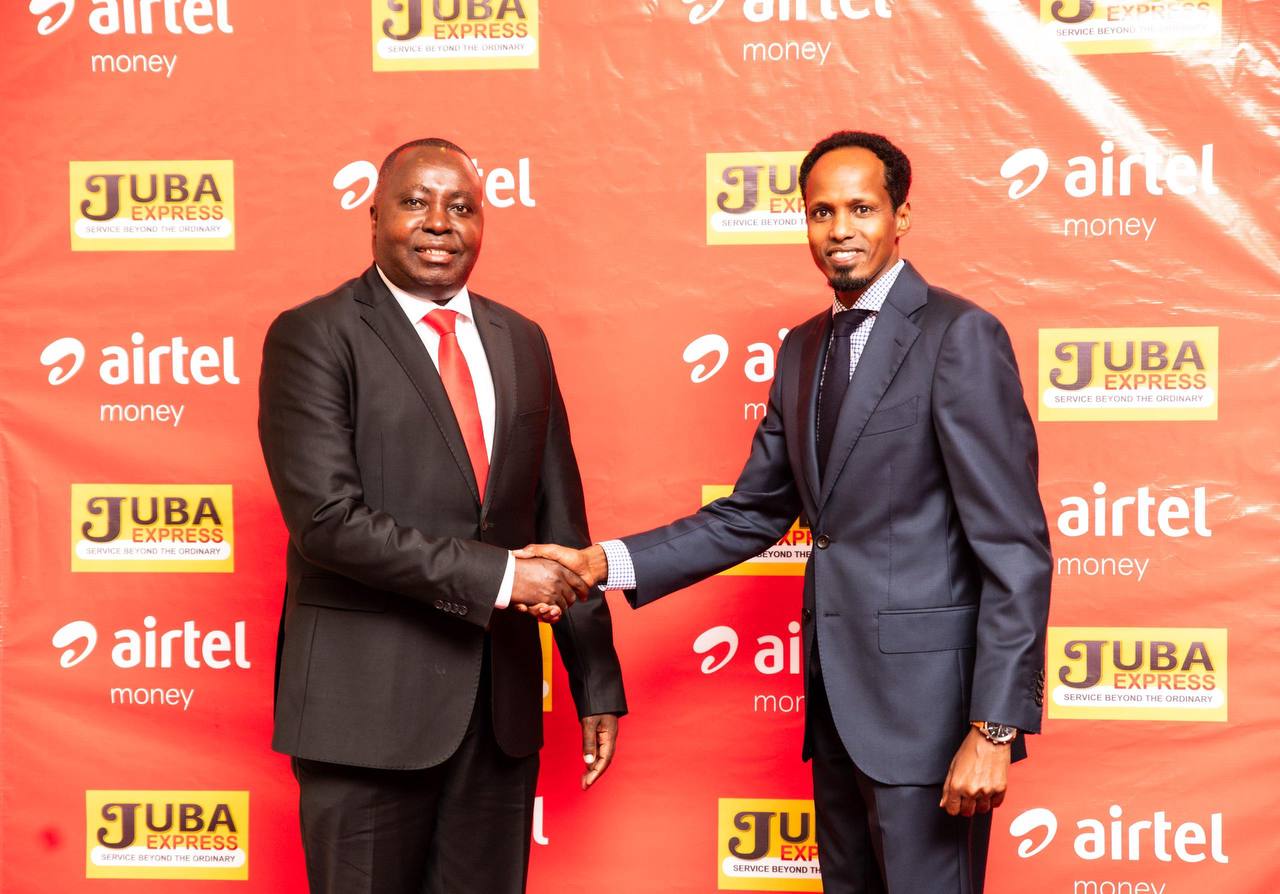

Japeth Aritho, MD, Airtel Money shakes hands with Hassam Mohammad, the Regional Director for Juba Express, during the partnership launch in Kampala.

Airtel Money has partnered with international payments firm Juba Express to roll out cross-border money transfers targeting Uganda’s growing diaspora connections and rising outflows to neighboring countries. The service, now accessible through Airtel’s *185# USSD menu, allows customers to send money to more than 120 countries directly from their mobile wallets.

The move comes as remittances continue to play a central role in Uganda’s economy. According to the World Bank’s Migration and Development Brief 2024, Uganda received an estimated USD 1.42 billion in inflows by early 2024, supporting household welfare, school fees, healthcare and small business investments. But outward remittances, especially to regional destinations, remain expensive and administratively cumbersome, with little sign of change

Tackling High Outbound Transfer Costs

For many Ugandans sending money abroad, the process has traditionally required navigating banks, forex bureaus and money-transfer operators with limited corridors. Juba Express regional manager Hassan Abdullah said this gap prompted the partnership.

“Ugandans face a challenge when sending money out of the country,” Abdullah told reporters. “You have to go to the bank or forex bureau, and options are limited. Now anyone with an Airtel line, smartphone or not can send money internationally using a single journey. You see the exchange rate, the charges, and there are no hidden fees.”

The service enables transfers to mobile wallets, bank accounts and cash-pickup points in markets as diverse as East Africa, the Middle East, Europe and North America. Transfer fees start at UGX 120, and users can send up to UGX 5 million per transaction.

Attempt to rein in fraud and strengthen compliance

With mobile-money fraud and money-laundering risks rising in Uganda, the companies say compliance has been integrated into the system. According to Abdullah, every Airtel Money user is already subject to existing Know-Your-Customer (KYC) registration rules.

“For first-time senders, the transaction doesn’t go instantly, it goes through anti-money laundering screening,” he said. “We verify that the sender’s names match the registered mobile line. It becomes difficult for someone to use a random SIM card to move funds.”

The companies say the partnership is regulated under the Bank of Uganda’s mobile-money and remittance frameworks.

Market opportunity

Uganda’s outbound remittances are significant but under-documented, especially within the East African region. Industry estimates cited by Juba Express suggest Ugandans send roughly USD 80 million annually to Rwanda and USD 250 million to Tanzania. Substantial flows also go to Kenya and South Sudan, with numbers believed to be higher when informal channels are considered.

With Airtel Money’s 14–15 million registered customers, Juba Express projects monthly transfer volumes between USD 10 million and USD 15 million once adoption grows.

Broader digital-finance competition

The launch intensifies competition among mobile-money platforms and fintechs racing to dominate cross-border payments in East Africa. MTN Uganda, Wave, Equity Bank, Safaricom’s M-Pesa Global, and independent remittance operators have all expanded international corridors over the past two years. Airtel and Juba Express are betting that affordability and broad reach will differentiate their service.

During the launch, Airtel Money Managing Director Japeth Aritho framed the service as part of a region-wide shift toward real-time digital payments. “Cross-border transactions remain the lifeblood of our global community,” he said, emphasizing the need for faster and more secure tools for families and businesses.

As digital-finance players compete to simplify global payments, the Airtel–Juba Express partnership could widen formal remittance channels particularly for low-income users who rely on USSD rather than smartphones.

The long-term test will be whether cost savings, compliance processes and corridor availability are sufficient to draw users away from informal networks that have long dominated Uganda’s outbound transfer market.