Airtel Africa profit jumps 136% as revenue tops $4.6bn

Airtel Africa Plc recorded a strong financial performance for the nine months ended December 31, 2025, with profit after tax rising to $586 million, up sharply from $248 million in the prior year. The 136.6% increase was driven by higher operating profits and a favourable swing in foreign exchange and derivative positions, which moved to a $99 million gain from a $153 million loss previously.

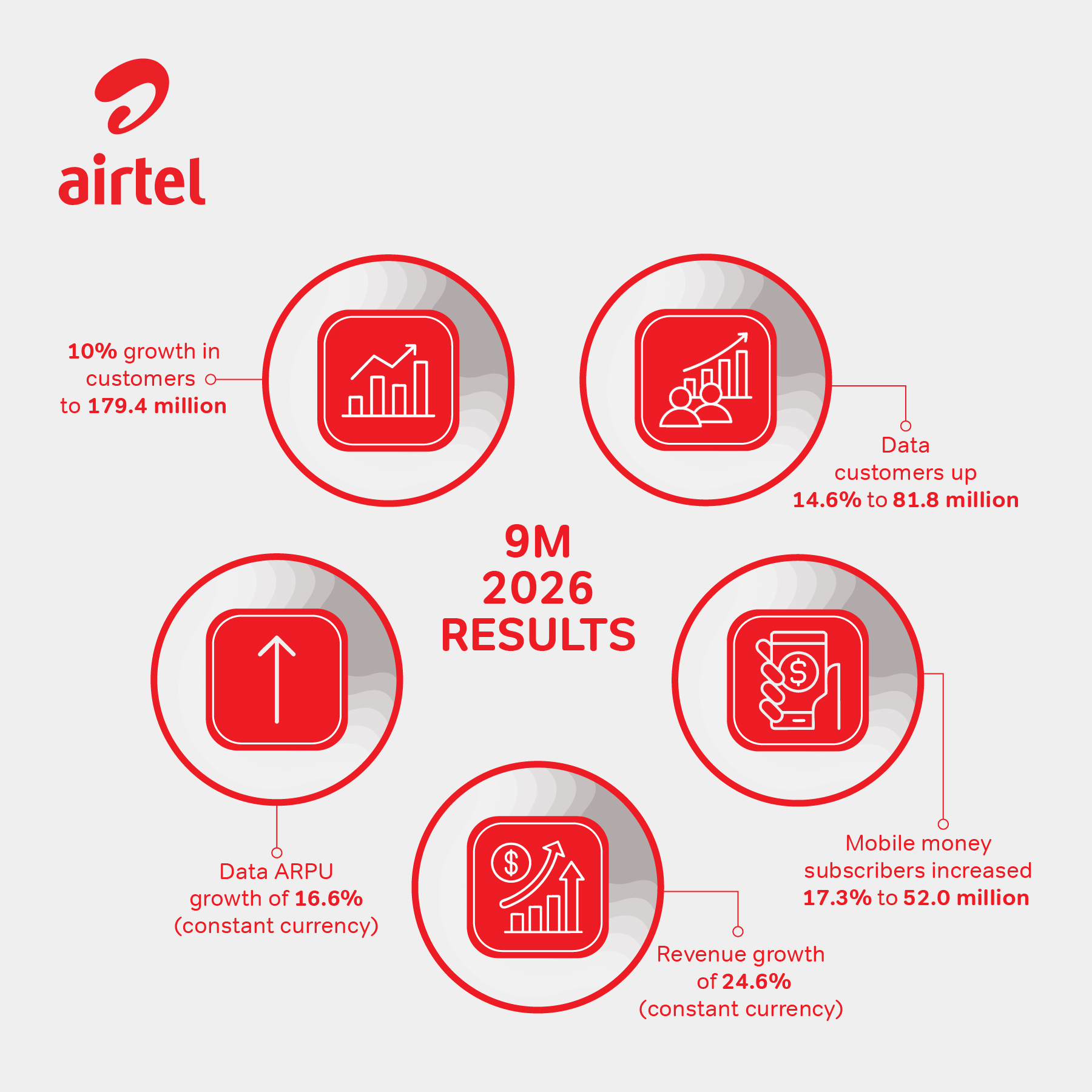

Total revenue increased 28.3% in reported currency to $4.67 billion, underpinned by 24.6% growth in constant currency and supported by currency appreciation in several key markets. EBITDA rose 35.9% to $2.28 billion, lifting margins to 48.9%, while operating profit climbed 41.3% to $1.53 billion. Basic earnings per share increased to 13.1 cents, and leverage improved as net debt to EBITDA fell to 1.9x from 2.4x a year earlier.

Operational momentum remained strong, with the customer base expanding 10% to 179.4 million. Data customers grew 14.6% to 81.8 million, supported by continued network investment that pushed average data usage to 8.6GB per customer per month and smartphone penetration to 48.1%.

Airtel Money delivered another robust performance, surpassing 50 million subscribers to reach 52 million customers, while annualised transaction value exceeded $210 billion. The company reiterated that plans to list the Airtel Money business in the first half of 2026 remain on track.

Regionally, Nigeria led growth with constant currency revenue up 50.6%, driven by tariff adjustments and strong data demand, with reported growth further boosted by naira appreciation. East Africa posted 18.5% constant currency growth on the back of expanded network coverage, while Francophone Africa recorded 17.0% constant currency growth, aided by a stronger CFA franc.

Strategic priorities during the period included a partnership with SpaceX’s Starlink to introduce direct to cell satellite connectivity in remote areas, and an infrastructure sharing agreement with Vodacom Group covering fibre and tower assets in Tanzania and the DRC. Capital expenditure totalled $603 million, supporting the rollout of 2,500 new sites and 4,000km of fibre.

Management cautioned that currency volatility, inflationary pressures, and regulatory changes, including Nigeria’s mandatory migration to the HA NVS platform, remain key risks. Nonetheless, the results highlight Airtel Africa’s strengthening operating performance, accelerating digital adoption, and improving balance sheet position.